Artificial Intelligence has been continuously improving our lives since its inception. Its ability to provide deep and thorough analytics as we try to apply it over several fields is astounding. It is being applied in a plethora of industries to enhance consumer reach, provide assistance to consumers and collect analytical information to improve its offerings.

Artificial Intelligence is not the answer to everything but in a hyper-competitive market place like an investment, banking smart tools can change the game in terms of productivity gains, lead generation capabilities and customer experience.

— Sofia Spencer

Banking is one of the many sectors where Artificial Intelligence could prove to be of critical importance by making the banking process painless for consumers and for the industry itself.

Artificial Intelligence in Banking Statistics

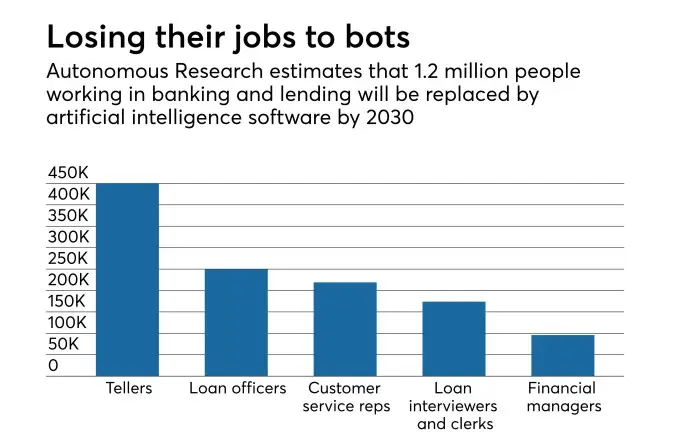

Technological improvements over the past few years have lead to a reduction in human involvement in several industries, with the advancements in Artificial Intelligence in banking, this number is set to grow at a faster rate.

● According to analysts, AI will result in more than $1 trillion in savings by 2030. Moreover, financial services players who will incorporate AI prudently will experience a 14% net gain in jobs and a 34% increase in revenues by 2022.

● According to Wells Fargo & Co., the next decade will have over 200,000 job cuts in the Banking industry due to technological improvements.

● The Reserve Bank of India faced a lot of criticism over its inability to forecast the changes in inflation levels by using outdated analytical models.

● Facial recognition technology once paired with AI will be able to easily curb credit card frauds.

● Banks, recently have been actively engaging themselves with vendors and are being offered strategic insight on the upcoming trends in IT.

How AI is Used in Banking

Artificial Intelligence is going to change the way we bank and it already is.

Banking is a sector where numbers are being crunched every second, trying to anticipate the next move of the market and customers involves working with heaps of data. Artificial Intelligence in banking industry is being used not just to process the data and identify risks but also to maintain happy customers by offering them specialized deals. Following are the areas specifically in Banking where AI is being used:

● Improving Customer Experience and Retention

With AI, banks can now use previously unorganized data to build highly distinct models to better understand their customers. By analyzing the customer’s usage patterns, banks are now able to provide customized offers to them. The model generated by the AI then adds to the collective knowledge of the institution.

Having a personalized touch maintains customer satisfaction while helping retain the customer longer. AI can also simplify and cut-short many previously tedious processes that can now be done with fewer clicks and taps.

Artificial Intelligence has the potential to transform customer experience and establish entirely new business models in banking. To achieve the highest level of results, there needs to be a collaboration between humans and machines that will require training and a reassessment of the future of work in banking.

— Jim Marous

● Forecasting of Upcoming Trends

By analyzing a customer’s usage patterns from a vast pool of data, AI can create a prediction on what the customers are likely to proceed. The intelligence derived from this can be used to generate actionable insight leading to a better understanding of customer usage patterns.

Artificial intelligence in banking industry is used to establish more meaningful conversations with customers by solving real problems and managing finances.

● Providing Better Support

By utilizing AI in chatbots, banks can leverage their benefits on guiding customer interaction in a manner that is easy and laid-back, not to mention at the comfort of the customer’s time. Using a chatbot can help save a great deal of time and cost that could’ve been spent on one to one conversation.

"Previously only used in the determination of risk, artificial intelligence is now increasingly being used to provide improved advice and recommendations based on transaction and behavioral data."

— Responsive.AI (@responsiveai) December 22, 2019

~ @JimMarous

How #Banking Can Avoid Disruption in 2020 https://t.co/txU1kI8v8k pic.twitter.com/1x316hhX4h

● For Safer Bank Transactions

By implementing Artificial Intelligence and Machine Learning’s continuous analysis of customer behavior, banks can pick suspicious activities by keeping a close watch on thousands of customer accounts. AI and ML have equipped banks with the ability to instantly identify and handle attempts made to capture customer accounts using phishing with swift action.

Technological innovations will be the heart and blood of the banking industry for many years to come and if big banks do not make the most of it, the new players from FinTech and large technology companies surely will.

– David Brear

● Cost Reduction

Leveraging the benefits of AI in banking sector, banks can save money on automating several of its back and middle office’s repetitive tasks, cutting down on operational costs. There are many ways AI helps reduce and even cuts costs, be it providing easy and quick support to customers’ queries in the form of chatbots or by producing extensive and crucial analytics profiting the industry.

How Artificial Intelligence Makes Banking Safe

Being a complicated technology, Artificial Intelligence can safeguard your money against waves of fraudulent transactions by learning your usual spending patterns. AI in banking can help make banking safe in the following ways:

● Risk Management

With the heaps of data at the disposal of AI and ML, it can run the data through various scenarios and isolate any potential cases where the outcome may lead to financial uncertainty. These risks can be identified and dealt with promptly to prevent damage to the reputation of the financial institution.

● Identifying Suspicious Activities

By analyzing how often, how much you usually spend and from where you do most of your banking activities, AI can alert you of suspicious and unusual transactions taking place on your account, controlling the number of fraud incidents. AI in the banking sector does all this by associating all your data with your online identity and consistently improves the model, making it better.

● Identifying and Fixing Security Flaws

Security solutions used by financial institutions can sometimes have several loopholes and exploits, that a hacker can misuse. Some of these are of critical nature which can cause irreparable damages to the bank. Using AI in banking, a number of these exploits can be identified and patched, making it harder for hackers to compromise security.

Are There Any Risks in Adopting Artificial Intelligence for Banking?

Artificial Intelligence provides several nifty benefits, but it does come with its fair share of concerns that might turn out to be a disappointment if not a deal-breaker for some. Below are some of the problems that Artificial Intelligence in the banking industry has been plagued with:

● Job Cuts

While implementing Artificial Intelligence in banking can often reduce employee’s workload, it can help make more jobs by creating new opportunities for AI professionals, causing job cuts in the process for some. Whenever a new technology has risen, people have always feared it might give rise to job cuts which have been true in some cases but not all.

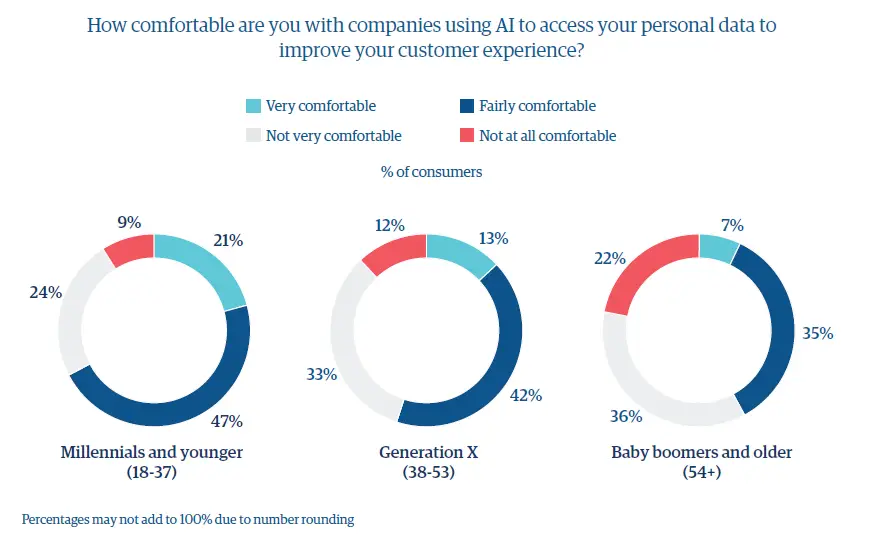

● Ethical Risks

Artificial Intelligence solely relies on analyzing user data, the data fed to any AI is enormous and is obtained from a massive pool of people, collecting this amount of data without prior knowledge of users can lead to ethical problems for any organization.

● Less Trust

The decrease in human engagement is one of the principal causes of concern which might lead to unsupervised actions, further leading to financial issues if not handled with precaution.

Artificial intelligence relies on our personal information in banking, policing, social media… wherever AI is used. How will we protect our human rights in this new era? Today I’m speaking at @CPRC_research #DataDialogue18 conference.

— Edward Santow (@esantow) July 15, 2018

● False-Positives Results

False-positives are the results of unexpected user behavior. These occur when the user does something different out of his usual patterns. It could include conducting banking services from a new country, transacting for larger than routine amounts.

How to Choose the Best Partner for Developing Artificial Intelligence Solutions for Your Financial Service

Implementing AI for a banking institution is not an easy task because you need to entrust the organization to developing the Artificial Intelligence and Machine Learning solution so that it clearly understands the financial and reputation risks involved. Every step of the way must be strategically planned with appropriate fall-back measures ready to spring into action in case they’re required.

Additionally, integrating Financial Reporting and Analysis with Power BI can significantly enhance the bank’s ability to interpret data insights and ensure robust financial oversight. This integration provides a comprehensive view of financial performance and helps in making data-driven decisions, thereby complementing the AI and ML efforts.

Choosing the right vendor is critical to achieving success in deploying an AI and ML solution for a financial institution. The service provider of your choice must:

● Be able to promptly deploy your model, capable of working with live data, backed by successful testing in a sandbox.

● Have developed a similar solution so that you can get a hands-on feel of what you’ll be getting at the end.

● Have a good understanding of the tools available, to guide you on what might be the best bang for your buck.

● Help you identify and evaluate your use cases and guide you through the development and deployment of your model.

Conclusion

The future belongs to AI and ML, soon both of these will be complementing our interaction with any system, making hard and monotonous tasks seemingly painless to carry out. The more data is fed to Artificial Intelligence, the better it gets at analyzing and predicting our future moves. AI will not just make our lives easy, but it will also help banks make more profit by actively driving their efforts with powerful insights to back it up.